Using Stock Market Tools for Better Investments

Investing in the stock market can be both thrilling and overwhelming. With countless variables influencing stock prices, making informed decisions is crucial for success. Fortunately, advancements in technology have introduced a wide range of stock market tools that can help investors make smarter, data-driven choices. Whether you’re a seasoned investor or just starting out, leveraging these tools can significantly enhance your investment strategy.

The Importance of Stock Market Tools in Modern Investing

The stock market is a fast-paced and ever-changing environment. Prices fluctuate constantly, trends emerge and fade, and news can impact stock performance within seconds. Without the right tools, it’s easy to feel overwhelmed by the sheer volume of information. Stock market tools provide clarity by offering real-time data, analytical insights, and predictive capabilities. They help investors cut through the noise and focus on what truly matters.

For example, tools like stock screeners allow you to filter stocks based on specific criteria such as market capitalization, dividend yield, or price-to-earnings ratio. This saves time and ensures you’re only considering stocks that align with your investment goals. Similarly, technical analysis software can help you identify patterns and trends, giving you a competitive edge in the market.

Exploring the Different Types of Stock Market Tools

There are numerous stock market tools available, each designed to serve a specific purpose. Below, we’ll discuss some of the most popular ones and how they can benefit your investment strategy.

Stock Screeners: Narrowing Down Your Options

Stock screeners are essential for narrowing down the vast universe of stocks. They allow you to filter stocks based on predefined criteria, such as sector, price range, or financial ratios. For instance, if you’re looking for undervalued stocks, you can set filters for low price-to-earnings ratios or high dividend yields. This targeted approach ensures you’re focusing on stocks that meet your investment criteria.

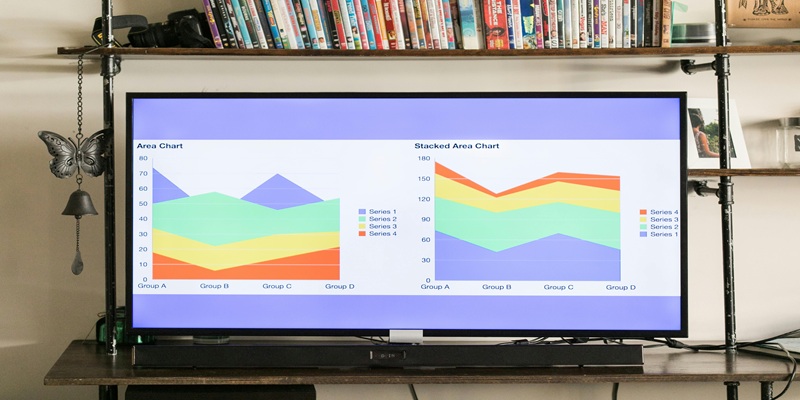

Technical Analysis Software: Identifying Market Trends

Technical analysis involves studying historical price and volume data to predict future movements. Tools like TradingView or MetaTrader provide advanced charting capabilities, enabling you to spot trends, support and resistance levels, and other key indicators. By understanding these patterns, you can make more informed decisions about when to buy or sell.

Fundamental Analysis Tools: Evaluating Financial Health

Fundamental analysis focuses on evaluating a company’s financial health. Tools like Yahoo Finance or Morningstar provide access to financial statements, earnings reports, and analyst ratings. These insights help you determine whether a stock is undervalued or overvalued, giving you a clearer picture of its long-term potential.

Portfolio Management Tools: Tracking and Rebalancing Investments

Managing a diversified portfolio can be challenging, especially if you’re holding multiple stocks. Portfolio management tools like Personal Capital or SigFig help you track your investments, monitor performance, and rebalance your portfolio as needed. They also provide insights into asset allocation, ensuring your portfolio aligns with your risk tolerance and financial goals.

News Aggregators: Staying Informed About Market Developments

The stock market is heavily influenced by news and events. Tools like Bloomberg or Seeking Alpha aggregate news from various sources, keeping you informed about market-moving developments. Staying updated on the latest news can help you react quickly to changes and make timely investment decisions.

Maximizing the Potential of Stock Market Tools: Practical Tips

While stock market tools are powerful, their effectiveness depends on how you use them. Here are some tips to help you get the most out of these tools:

Define Your Investment Goals Clearly

Before using any tool, it’s important to define your investment goals. Are you looking for long-term growth, income through dividends, or short-term gains? Your goals will determine which tools are most relevant and how you should use them.

Combine Multiple Tools for a Holistic Approach

No single tool can provide all the answers. For example, while technical analysis software can help you identify entry and exit points, fundamental analysis tools can help you assess a company’s long-term potential. By combining multiple tools, you can make more well-rounded decisions.

Stay Consistent in Your Analysis and Monitoring

Consistency is key when using stock market tools. Make it a habit to regularly check your portfolio, review news updates, and analyze trends. Over time, this consistency will help you develop a deeper understanding of the market and improve your decision-making skills.

Avoid Overloading on Information

While it’s important to stay informed, too much information can lead to analysis paralysis. Focus on the tools and data that are most relevant to your investment strategy, and avoid getting bogged down by unnecessary details.

Keep Learning and Adapting to New Tools

The stock market is constantly evolving, and so are the tools available to investors. Stay curious and keep learning about new tools, features, and strategies. This will help you stay ahead of the curve and adapt to changing market conditions.

The Benefits of Using Stock Market Tools for Investors

Using stock market tools offers several advantages that can enhance your investment experience. Here are some of the key benefits:

Improved Decision-Making Through Data-Driven Insights

Stock market tools provide data-driven insights that can help you make more informed decisions. Whether it’s identifying undervalued stocks or spotting emerging trends, these tools give you the information you need to act confidently.

Time Efficiency Through Automation

Manually analyzing stocks and tracking market trends can be time-consuming. Stock market tools automate many of these tasks, saving you time and allowing you to focus on strategy and execution.

Reduced Emotional Bias in Investment Decisions

Emotions can cloud judgment and lead to poor investment decisions. By relying on data and analytics, stock market tools help you stay objective and avoid impulsive actions.

Enhanced Risk Management Capabilities

Tools like portfolio managers and risk analyzers help you monitor your investments and identify potential risks. This allows you to take proactive measures to protect your portfolio and minimize losses.

Access to Real-Time Data for Timely Actions

Timing is everything. Stock market tools provide real-time data, enabling you to react quickly to market changes and seize opportunities as they arise.

Common Mistakes to Avoid When Using Stock Market Tools

While stock market tools are incredibly useful, they’re not foolproof. Here are some common mistakes to avoid:

Over-Reliance on Tools Without Personal Judgment

While tools can provide valuable insights, they shouldn’t replace your own judgment. Always use tools as a supplement to your research and analysis, not as a substitute.

Ignoring Market Fundamentals in Favor of Technical Analysis

Technical analysis tools are great for identifying trends, but they shouldn’t be used in isolation. Always consider fundamental factors like a company’s financial health and industry position.

Failing to Update Tools and Software Regularly

Stock market tools are only as good as the data they provide. Make sure your tools are up-to-date and configured correctly to ensure accurate results.

Neglecting to Diversify Your Investment Portfolio

Even the best tools can’t predict every market movement. Diversifying your portfolio helps spread risk and reduces the impact of any single investment’s performance.

Conclusion

Using stock market tools is a game-changer for investors looking to make better, more informed decisions. From stock screeners to portfolio management software, these tools offer a wealth of data and insights that can help you navigate the complexities of the market. By defining your goals, combining multiple tools, and staying consistent, you can maximize their potential and achieve your investment objectives.

Remember, while tools are powerful, they’re not a substitute for sound judgment and continuous learning. Stay curious, keep refining your strategy, and use these tools to complement your investment journey. With the right approach, you’ll be well-equipped to make smarter investments and achieve long-term success in the stock market.