Neurodiversity and Money Management: Empowering ADHD Minds to Thrive Financially

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

October is ADHD Awareness Month, so it’s the perfect time to talk about an important topic that affects many neurodiverse individuals—money management. Let’s face it: managing finances can be challenging for anyone. But if you’re living with ADHD (like me!) or another form of neurodiversity, following the typical “one-size-fits-all” financial advice might feel overwhelming, frustrating, or downright impossible.

Neurodiverse individuals have brains that function in ways that differ from the typical or “neurotypical” brain. As noted by the Cleveland Clinic, neurodiversity includes conditions such as autism spectrum disorder, ADHD, dyslexia, social anxiety, bipolar disorder, and more.

Neurodiversity is more common than you might think. According to the National Cancer Institute, approximately 15% to 20% of the global population is neurodiverse.

The good news? Financial wellness is absolutely achievable when you find approaches and tools designed with neurodiversity in mind. I’ll share some tips that have worked well for me and others I know.

The Unique Money Challenges for Neurodiverse Minds

For neurodiverse individuals, traditional budgeting and saving advice can feel stifling, if not completely unrealistic. People with ADHD, for example, often struggle with:

- Impulsivity: ADHD can lead to impulse purchases or an inconsistent savings pattern, where keeping money for future goals feels harder than the shiny new object on sale on Amazon.

- Difficulty with Routine: Many financial plans hinge on following strict rules, which might not mesh well with those who thrive on spontaneity or creative thinking.

- Overwhelm: Managing a pile of bills, paying down debts, and keeping track of a budget often feels like juggling too many tasks at once, leading to stress and avoidance.

- Executive Functioning Struggles: This makes it harder to prioritize tasks, stay organized, or consistently keep track of financial decisions and progress.

These challenges don’t mean financial success is out of reach—it just means you need to take a different approach. Effectively managing your money is not only possible, but dare I say, can be fun, engaging, and rewarding!

1. Make Money Management Fun (Yes, Really!)

The secret to success? Motivate yourself with fun and rewards. If traditional budgeting feels like a chore, try turning it into a game. Set small, achievable financial goals, and reward yourself for hitting them! Whether it’s treating yourself to your favorite coffee when you reach a mini-savings milestone or celebrating a week of sticking to your plan with a movie night, rewards keep you engaged and looking forward to progress.

To keep it interesting:

- Create challenges: Can you save $500 by the end of the month? Turn saving into a personal challenge.

2. Try Reverse Budgeting: Freedom with a Twist

For people with ADHD, traditional strict budgets can feel suffocating. Instead of meticulously tracking every dollar spent, try reverse budgeting. Here’s how it works: You prioritize your savings and financial goals first, and spend whatever’s left over however you want. This flips the budgeting script and offers the freedom to spend on what brings you joy, while ensuring your big-picture financial goals are still on track.

For example, if you want to save $200 a month, set that aside first with a transfer from your checking into your savings. You can do the same with your 401(k) contributions, right from your paycheck. Once your savings are sorted, the rest is yours to spend however you see fit—guilt-free!

3. Leverage Technology to Simplify and Track Progress

Money management doesn’t have to mean diving into confusing spreadsheets or overwhelming charts. There are fantastic tools out there designed to make finances fun and easy for neurodiverse individuals.

- Elements: This is a tool I offer to clients for tracking your financial progress in a clear, visual way. It lets you break down your goals, track spending, and see how each dollar gets you closer to your dreams. The interface is colorful and interactive, which is perfect for keeping you engaged.

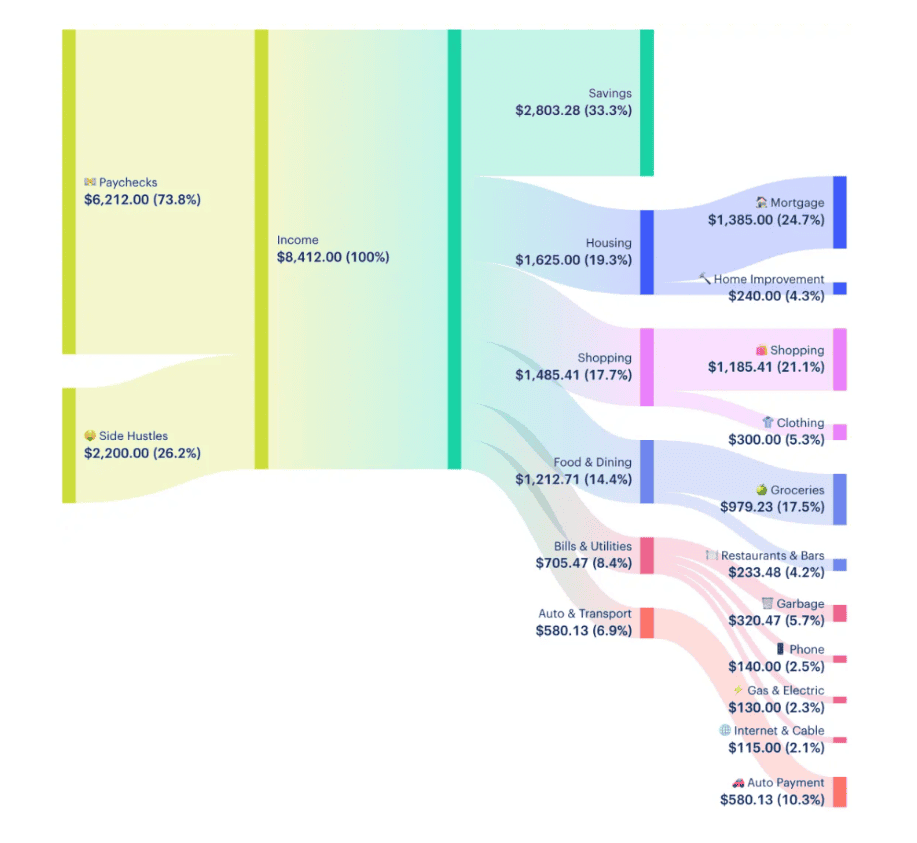

- Monarch Money: Another favorite! Monarch Money gives you a holistic view of your finances, with goal tracking, spending breakdowns, and financial health insights—all in one easy-to-navigate, visual app. It turns financial planning into a colorful, enjoyable process instead of a monotonous task.

Both of these tools give you real-time feedback and make financial wellness feel achievable by simplifying what could otherwise feel overwhelming.

4. Small Wins Add Up to Big Progress

ADHD brains thrive on small, quick wins. Break your financial goals into tiny, bite-sized tasks that you can knock out in no time, also known as habit stacking. Whether it’s saving an extra $10 this week or paying down a small chunk of debt using the debt snowball method, these little victories will keep you motivated and give you a sense of accomplishment.

And the best part? By stacking up these small wins, you’ll eventually notice big progress. Over time, those $10 savings add up, and before you know it, you’ve achieved a financial goal you once thought was out of reach.

5. Embrace Flexibility and Forgiveness

Lastly, remember that financial management for neurodiverse individuals needs to be flexible. There will be weeks when sticking to a plan is tougher than others, and that’s okay. It’s important to build a system that allows for some grace when things don’t go perfectly. You can always course correct later.

Financial Wellness Is Possible—Your Way

ADHD and other forms of neurodiversity may present unique challenges, but they also offer unique strengths. By harnessing creativity, fun, and strategic tools, financial wellness is not only possible but can also be enjoyable. Whether it’s using apps like Elements and Monarch Money, creating a rewards-based system, or trying out reverse budgeting, the key is finding what works for you and your unique brain!

This article was originally published here and is republished on Wealthtender with permission.